Real Estate Professional Net Investment Income Tax . first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%. significant tax advantages—including the ability to deduct losses against nonpassive income and. it’s important to note that rental activities are considered passive by default, so achieving real estate. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi).

from db-excel.com

the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. significant tax advantages—including the ability to deduct losses against nonpassive income and. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. it’s important to note that rental activities are considered passive by default, so achieving real estate.

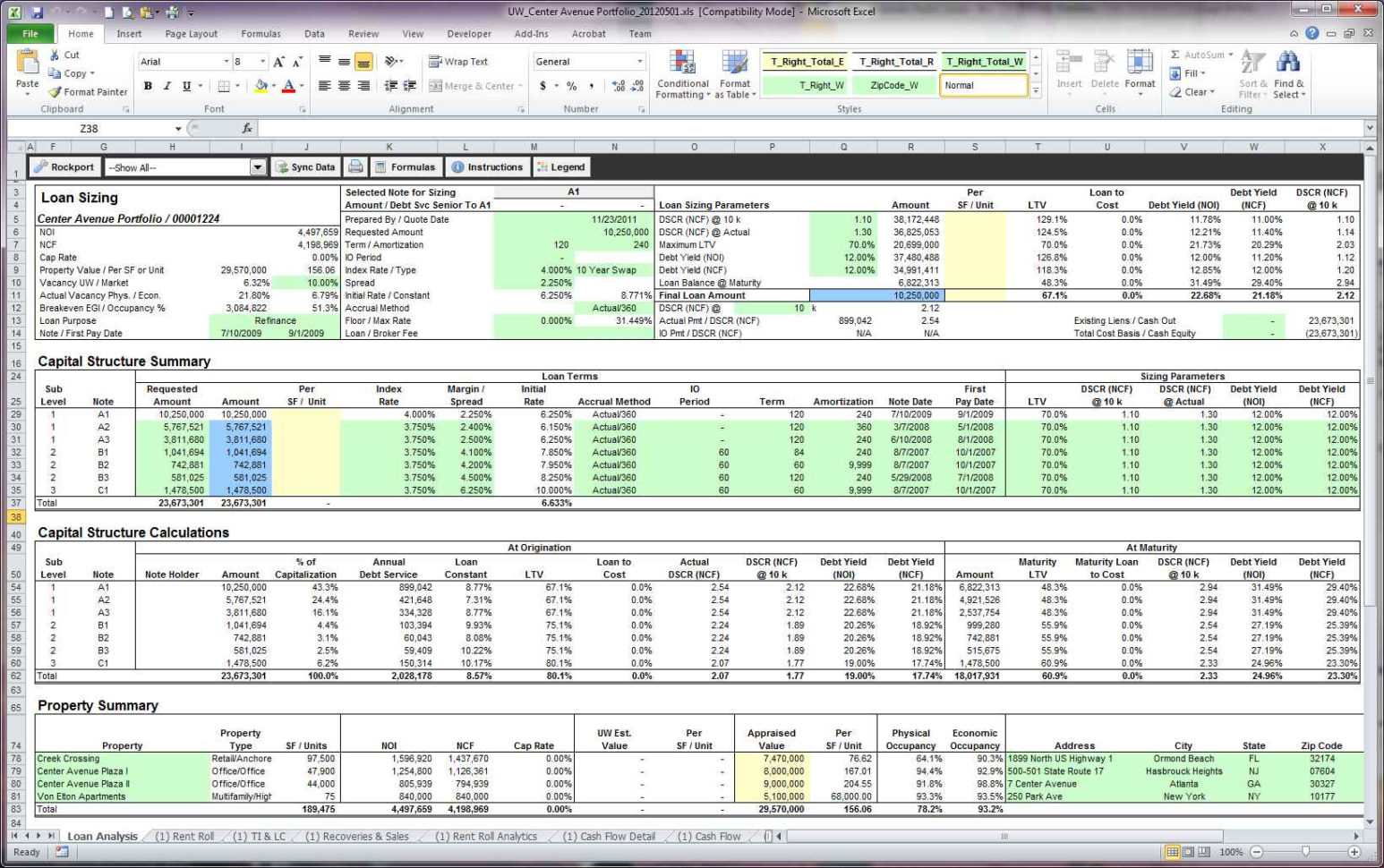

Real Estate Investment Analysis Excel Spreadsheet As Free with Real

Real Estate Professional Net Investment Income Tax significant tax advantages—including the ability to deduct losses against nonpassive income and. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. significant tax advantages—including the ability to deduct losses against nonpassive income and. it’s important to note that rental activities are considered passive by default, so achieving real estate. the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%.

From kizatalking.weebly.com

Noi calculation in real estate kizatalking Real Estate Professional Net Investment Income Tax significant tax advantages—including the ability to deduct losses against nonpassive income and. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). it’s important to note that rental activities are considered passive by default, so achieving real estate. first, it establishes whether the taxpayer can deduct. Real Estate Professional Net Investment Income Tax.

From db-excel.com

Financial Analysis Excel Spreadsheet — Real Estate Professional Net Investment Income Tax the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). significant tax advantages—including the ability to deduct losses against nonpassive income and. the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%. first, it establishes whether the taxpayer. Real Estate Professional Net Investment Income Tax.

From db-excel.com

Investment Property Calculator Spreadsheet for Real Estate Investment Real Estate Professional Net Investment Income Tax significant tax advantages—including the ability to deduct losses against nonpassive income and. the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). for individual income tax purposes exclusive. Real Estate Professional Net Investment Income Tax.

From www.investopedia.com

How to Assess a Real Estate Investment Trust (REIT) Using FFO/AFFO Real Estate Professional Net Investment Income Tax the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). it’s important to note that rental activities are considered passive by default, so achieving real estate. the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%. significant tax. Real Estate Professional Net Investment Income Tax.

From db-excel.com

Real Estate Investment Spreadsheet Templates Free within Rental Real Estate Professional Net Investment Income Tax it’s important to note that rental activities are considered passive by default, so achieving real estate. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). first, it establishes whether. Real Estate Professional Net Investment Income Tax.

From www.youtube.com

When and How to Use the Real Estate Professional Tax Strategy YouTube Real Estate Professional Net Investment Income Tax it’s important to note that rental activities are considered passive by default, so achieving real estate. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). first, it establishes whether. Real Estate Professional Net Investment Income Tax.

From blog.providencegrouprealty.com

Reasons to Hire a Real Estate Professional [INFOGRAPHIC] Providence Real Estate Professional Net Investment Income Tax it’s important to note that rental activities are considered passive by default, so achieving real estate. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). the net investment income. Real Estate Professional Net Investment Income Tax.

From goc-oivf2.blogspot.com

43 realtor tax deduction worksheet Worksheet Information Real Estate Professional Net Investment Income Tax the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%. for individual. Real Estate Professional Net Investment Income Tax.

From www.pinterest.com

This infographic explains the power of leverage in regards to real Real Estate Professional Net Investment Income Tax the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). it’s important to note that rental activities are considered passive by default, so achieving real estate. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. significant tax advantages—including the. Real Estate Professional Net Investment Income Tax.

From www.cabinetcorp.com

Six Secrets Behind Every Successful Real Estate Investor Real Estate Professional Net Investment Income Tax the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%. significant tax advantages—including the ability to deduct losses against nonpassive income and. first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. for individual income tax purposes exclusive of the 3.8% net. Real Estate Professional Net Investment Income Tax.

From www.albertarealtor.ca

Webinar Taxes 101 Real Estate Professionals Real Estate Professional Net Investment Income Tax first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. it’s important to note that rental activities are considered passive by default, so achieving real estate. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. significant tax advantages—including the ability to deduct losses. Real Estate Professional Net Investment Income Tax.

From printableformsfree.com

Nii Application Form 2023 Printable Forms Free Online Real Estate Professional Net Investment Income Tax it’s important to note that rental activities are considered passive by default, so achieving real estate. significant tax advantages—including the ability to deduct losses against nonpassive income and. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). the net investment income tax (niit) essentially raises. Real Estate Professional Net Investment Income Tax.

From healthywealthywiseproject.com

Rental Property Analysis Excel Spreadsheet Real Estate Professional Net Investment Income Tax significant tax advantages—including the ability to deduct losses against nonpassive income and. it’s important to note that rental activities are considered passive by default, so achieving real estate. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. the rate is 3.8% of the lower of net investment income or. Real Estate Professional Net Investment Income Tax.

From www.educba.com

Net Formula Calculator (With Excel template) Real Estate Professional Net Investment Income Tax it’s important to note that rental activities are considered passive by default, so achieving real estate. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. the net investment income. Real Estate Professional Net Investment Income Tax.

From www.mashvisor.com

Real Estate Professional 10 Tips to Qualify Mashvisor Real Estate Professional Net Investment Income Tax significant tax advantages—including the ability to deduct losses against nonpassive income and. first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). it’s important to note that rental activities are. Real Estate Professional Net Investment Income Tax.

From www.stessa.com

Real Estate Tax Strategies For 2023 Everything You Need To Know Real Estate Professional Net Investment Income Tax first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. the net investment income tax (niit) essentially raises the top capital gain tax bracket from 20% to 23.8%. the rate is 3.8% of the lower of net investment income or the amount of modified adjusted gross income (magi). significant tax. Real Estate Professional Net Investment Income Tax.

From elishiaaziz.blogspot.com

Selling rental property tax calculator ElishiaAziz Real Estate Professional Net Investment Income Tax significant tax advantages—including the ability to deduct losses against nonpassive income and. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. it’s important to note that rental activities are considered passive by default,. Real Estate Professional Net Investment Income Tax.

From sharedeconomycpa.com

What is a Real Estate Professional? Shared Economy Tax Real Estate Professional Net Investment Income Tax significant tax advantages—including the ability to deduct losses against nonpassive income and. for individual income tax purposes exclusive of the 3.8% net investment income tax imposed by sec. first, it establishes whether the taxpayer can deduct losses from real estate activities against ordinary income. the net investment income tax (niit) essentially raises the top capital gain. Real Estate Professional Net Investment Income Tax.